I’m thinking about buying an electric car. What financial incentives are available to me?

The company car is getting its moment again as an exciting tax perk. In a climate conscious age, where Tesla has become a household name, business owners are being encouraged to take to the road in an electric company car.

Choosing to invest in an ultra low emission vehicle (ULEV) has plenty of environmental benefits. But alongside the benefits to the planet, it also comes with significant financial benefits for your business. If you’re already thinking about a company car, or making a switch to electric – now might be the perfect time, due to a series of government grants and financial incentives.

Let’s look at those grants and benefits in detail:

Government grants for ULEVs

These have been removed

Grants for charging ULEVs

The government also have initiatives in place to reduce the cost of charging your electric vehicle, as follows:

- If you want to install a workplace charging socket – the workplace charging scheme grants up to £350 per charging socket for up to 40 sockets.

- If you want to install a charging socket at home – the company car driver can be granted up to £350 for installing a chargepoint at home, presuming they have off-street parking.

In addition to Government grants, there are lots of tax benefits for ultra low emission vehicles

These include:

- Zero benefit-in-kind car tax – this has been removed since April 2021 for electric vehicles.

- Benefit in Kind (BIK) despite the removal of the 0% rate, the rates are significantly beneficial compared to conventional cars. For example the starting rate of 1% for emission free cars will only increase to 2% by 2024/2025.

The tax benefit decreases if the “electric range” is reduced, so for example an electric range of more than 130 miles will have a benefit in kind (BIK) of 1% compared to 10% for a range of 30-39 miles.

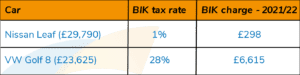

However compare an all electric car against a convention mid range car

The huge difference is to provide an incentive for drivers to choose a more environmentally friendly car.

- Enhanced capital allowances of up to 100% of the cost of a new company car are available to you when investing in an ultra low emission vehicle. This is only available for new cars with CO2 emissions of 0 g/km after 1 April 2021.

- Road Tax – Fully electric cars are exempt from Vehicle Excise Duty (VED)

- 100% discount on the London congestion charge – If you’re working in and out of London you’ll no longer need to consider the congestion charge, as your electric vehicle will be compliant with the clean air zone standards.

- Similarly, 100% exemption applies to the Ultra Low Emission Zone (ULEZ) which has just been extended this month to include all areas within the north and south circular.

For some, it may be more beneficial to lease an electric company car than buy outright

Buying outright isn’t your only option when it comes to investing in an electric vehicle. Leasing may be a more advantageous option for spreading out the cost of the car.

Importantly, If you lease your electric company car through your limited company you can reclaim 50% VAT on lease payments, and 100% of the VAT on the maintenance agreement. On a company van used only for work purposes, you can claim up to 100% VAT back.

You might also consider that electric models are developing all the time, and so leasing may give you the flexibility to upgrade later down the line.

Let us help you figure out the best choice for you

One size may not fit all when going electric. Some may be better off purchasing an electric car outright, some may benefit more from leasing. You’ll feel more confident in your decision when you can assess the tax benefits for your situation and make an informed decision.

As of 2021, you may need to provide additional information on your P11D if you own an electric company car with emissions of 1-50g/km. This includes providing your vehicle’s zero-emission mileage via a new field on the form.

If you want help deciding whether or not to buy that Electric car, get in touch. Email your normal manager at Myers Clark.

If you are not working with us yet, get the help you need by filling in our form to speak to an expert. We’ll make it as easy as possible to do your part for the environment!