In 2022, the Supreme Court ruled that the old 12.07% calculation for casual workers, which had been used for years, was no longer relevant. Due to these changes to holiday pay for irregular hours, many businesses have had to rethink their policies. The ruling stated that employees with irregular hours, including those on zero-hour contracts, […]

Author Archives: Priya Raja-Motala

Benjamin Franklin once said, “In this world, nothing can be said to be certain, except death and taxes.” If you are in business, a landlord, or paying tax under self-assessment, you understand the importance of paying your tax on time. But what if you can’t afford to pay your taxes when they are due? Remember […]

Even in the midst of success, many business owners are harbouring internal fears about the future. Family-owned Emery Little Wealth Management (EL) had successfully navigated the start-up and growth phases of their business. They were well established with a solid team, good clients, and regular revenue. Outwardly, their foundation seemed unshakeable. Internally, the owners were […]

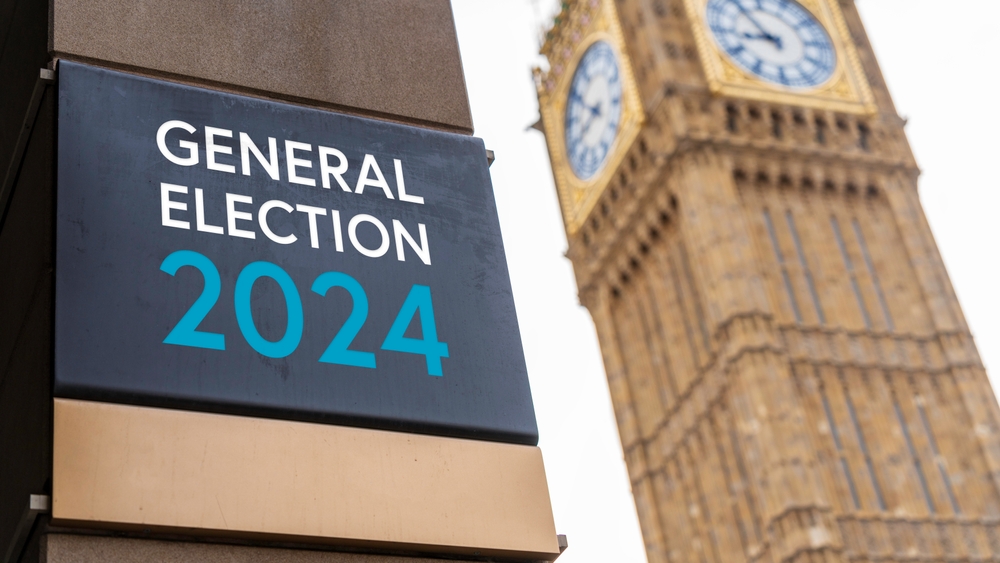

Have you had enough of the electioneering and all the televised debates? Or perhaps you’ve been finding some light relief from the politics by watching the Euro’s 2024. As we write this blog, we are reminded that only ten days are left before voting day. A new government could bring about significant changes in legislation […]

When you are running your own business, you can choose to operate as a self-employed individual or through a limited company. Many clients prefer the company option because it provides an extra layer of protection. However, when it comes to finances, can a director be held responsible for the company’s debt? What’s the difference […]

Setting up a business is both exciting and worrying. There’s so much to do and the topic of tax deductible expenses for business might not even be on the radar! However, no doubt you want to optimise your tax position whilst making sure you stay on the right side of HM Revenue and Customs (HMRC). […]

The Prime Minister, Rishi Sunak, called a general election last week, scheduled for July 4, 2024. This will mark the first July election since 1945. There is only a six-week campaign period. As a result, there will be no pre-election fiscal statement. Instead, the government is relying on the drop in inflation to 2.3% and […]

With uncertainty looming over the UK economy, making sound decisions for your business is more crucial than ever. We think using cloud accounting is part of the solution and there are countless reasons why your business needs management information. Cloud Accounting If you are using cloud accounting you are on the right path but […]

When selling your home, there are plenty of things to consider and take care of, but tax does not usually fall under that umbrella. The good news is that you typically don’t have to pay tax on the sale of your home or primary residence which is its official name. Capital Gains Tax (CGT) is […]

According to the Office of National Statistics. (ONS) in early April 2024, one in five (22%) of trading businesses were affected by current uncertainty. Long-term growth also remains a huge concern. This is therefore a good time to remind you to look out for warning signs of insolvency. Common warning signs could signal financial and […]