Are you thinking of selling an asset? Or have you recently sold or gifted an asset that gave rise to a Capital Gains Tax (CGT) liability? If so, there is an often underutilised relief that could improve your cash position; Capital Gains Tax Deferral Relief. If you pay income tax at the higher or […]

Category Archives: Tax Advice

Why will be it be necessary to do some tax planning moving forward. You may have seen in the press last week, there is not going be a “U” turn with the introduction of the new health social care levy. The UK government borrowed another £16.8 billion in December 2021 and the Covid 19 pandemic […]

For a few months now, we have known there is an acute shortage of talented people in the general workforce in the United Kingdom. Some industries such as hospitality are having more of an acute shortage due to other factors such as Brexit, but staff shortage is spreading across all industries and in all parts […]

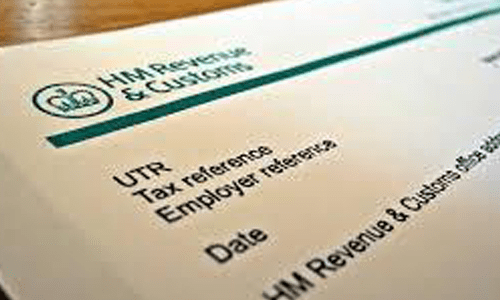

Do you ever get the impression that to simplify processes, the government complicates it even more? One example is the “simplification” of the Capital Gains Tax (CGT) regime regarding reporting. Selling an investment property and capital gains tax should be something on your mind if you are a landlord. Whilst trying to simplify the process […]

The PSA mechanism allows you to make one annual payment to HMRC which will cover the tax and all national insurance due on the expense or benefit.

The government has committed to investing £22 billion in R&D by 2025 and this was again confirmed in the 2021 budget. The UK is recognised as a world leader when it comes to research and innovations

We accept that this year is a bit different. Many of you have been under immense pressure at work for the last ten months and completing your tax returns has not been your top priority.

The Chancellor said the aim was to “give everyone the opportunity of good and secure work, so no one is left without hope.”

Another TV presenter loses an IR35 case…

HM Treasury has published its “report and conclusions” from their review…