Even the most experienced decision makers rely on accurate data to help them make sound decisions. As a forward-thinking business owner, you deserve a forward thinking accounting software to provide you with the financial data you need to drive decisions.

As you grow your business even the more simple tasks, like keeping records of your invoices, can become a drain on your time.

Enlisting the right accounting software is just as important as finding the right time management software, or a great CRM system. You don’t want to (and can’t afford to) be spending more time than is necessary on accounting tasks. You want to be able to share the load with your team, your bookkeeper or accountant, and automate what can be automated.

Today we’re going to look at the difference between using a desktop software option and a cloud software option. We’ll talk about our preferred cloud accounting option – Quickbooks Online (QBO) and compare it to the most popular desktop option – Sage 50C.

First, it’s important to understand why we suggest choosing a cloud software option over a desktop software option

The main difference between cloud software and traditional desktop software is access plus automation.

Before cloud options existed, your accounting software was a desktop programme. It was hosted on a hard drive on one computer in the firm and therefore could only be accessed via one computer or your local server.

Thankfully, nowadays we have the option of cloud accounting. Cloud software is hosted and maintained on central servers and can be accessed by multiple users via the internet. This means your data is stored more securely (there’s no risk of your one central computer being damaged) and you can view said data on any device at any time.

Using cloud accounting software allows us to be in partnership with you in a dual control environment, on a real-time basis, providing advice and support in a proactive way. We’re able to automate several bookkeeping processes, either taking them off their hands completely, or significantly reducing the time they’re spending on them.

With a cloud software option, we’re able to access your accounts alongside you, so we can help you quickly. Even something as simple as checking in on your cash flow is a longer drawn out process when using desktop software. We’re unable to see your data regularly, which means we’re unable to track your progress and raise the alarm when we see a potential issue arising.

But most importantly, cloud software provides you with access to your key numbers. It serves as the foundation for understanding your business on a strategic level.

You’re probably thinking – aren’t all modern software offerings cloud based? And the answer is – well, sort of. But not all are created equal.

Let’s look at the different options based on where you’re coming at this decision from.

If you’ve historically used a desktop Sage programme, you’re better off switching to a more established new product than upgrading to Sage Accounting business cloud

If you’re reading this blog and you’ve been using Sage for a long time, you might be looking to upgrade your old desktop version – because it doesn’t do all the useful things cloud software options do. Using a desktop version may suddenly be more frustrating than ever, since the pandemic forced us all into remote working and local servers became less accessible.

If you are a Sage desktop user you will now be under the subscription model often referred to as Sage Business Cloud. It’s important to note that Sage business cloud isn’t quite the same as the other cloud based options you’re seeing advertised. It’s a Sage hosted service, which means it is still primarily a desktop programme. The reason it has ‘cloud’ in the name, is because it comes with some helpful new cloud-based add ons, for example, you’re able to host it on your PC and it can be accessed remotely elsewhere.

While this is a step forward, it’s more worth your time and energy to switch to a future-proofed software. You want more than a few cloud-based features. You want your internal team and accountants to be able to manage your numbers remotely, and you want access to a wide range of online integrations to get tasks completed more efficiently. If you’re going to make any change, you may as well go the whole hog.

Quickbooks Online and Sage Accounting – how do their features compare?

Though Sage Business Cloud Accounting was late in coming to the market behind Quickbooks Online, you’ll find many similar benefits and features. Here’s an overview of the two options:

QuickBooks Online is a completely independent version of QuickBooks from the historical desktop versions. It works in real-time and automatically updates your bank accounts, increasing efficiency and ease. It has a sleek design with an easy-to-use dashboard that instantly shows you how your business is doing. QuickBooks Online integrates with OCR software to automate your processes and integrates with most apps on the market.

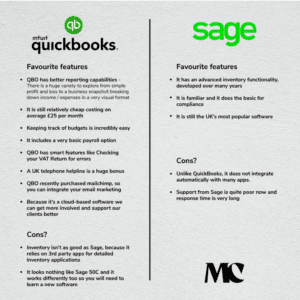

Some of our favourite features:

- QBO has better reporting capabilities – There is a huge variety to explore from simple profit and loss to a business snapshot breaking down income / expenses in a very visual format

- It is still relatively cheap costing on average £25 per month

- Keeping track of budgets is incredibly easy plus you can run a cashflow

- It includes a very basic payroll option

- QBO has smart features like Checking your VAT Return for errors

- A UK telephone helpline is a huge bonus

- QBO recently purchased mailchimp, so you can integrate your email marketing

- QuickBooks are now longer to continuing with their desktop version after next year so unlike SAGE all their resources will go into the development of the cloud software

Cons?

- Inventory isn’t as good as Sage desktop, because it relies on 3rd party apps for detailed inventory applications

- It looks completely different to SAGE 50C and so time will need to be devoted to learning another software

Sage Accounting provides simple online services for growing or established small businesses. Just like QuickBooks the software facilitates the management of cash flow, quotes, income, expenses and VAT. By acquiring Auto Entry it allows OCR reading of bank statements and invoices so a separate App is not needed.

Some of our favourite features:

- It has an advanced inventory functionality, developed over many years

- It does the basic for compliance and it is on a growth mission

- It is still the UK’s most popular software and a household name albeit not for cloud accounting

Cons?

- It does not look like Sage 50 which many of you are used to

- Unlike QuickBooks, it does not integrate automatically with many apps.

- Support from Sage is quite poor now and response time is very long

- Does not include a basic payroll function, so you pay substantially more for a payroll module

- Sage are still maintaining hosted and the online product so future development may be at a slower pace

While Sage does have some powerful features, we believe the cons outweigh the pros. The most significant difference between the two options is in communication and integrations.

Communication: We’ve found Sage support is very weak, whether by phone call or chat. QBO has a UK call centre and can take over your device if need be.

Integrations: QBO connects with over 650 popular business apps, many you may already be using. Here’s a list of all the current integrations. Sage is less developed in this areas, with a smaller app marketplace.

Cost shouldn’t be the major factor in your decision

For a fair comparison between the two software options, it’s important to mention cost.

Both Sage products and Quickbooks online have a three tiered model, whereby costs increase based on features and/or users. Comparatively, Sage’s desktop option is the highest in price. But the more important consideration than cost, is what you want your accounting software to do for you now and in the future.

For an ambitious business owner looking for the most efficient way to manage the business, we recommend Quickbooks. Being able to integrate the apps you use across your business (or any new ones you find as a result of transitioning) is a game changer. All your systems talk to each other, and you can see the result of small improvements to your bottom line.

It’s important to consider your accountants, too! As trusted bookkeepers and advisors to our clients, we’re regularly using Quickbooks in partnership with them. We find Quickbooks Online to be the best option for collaboration. And yet, whilst you need some accounting knowledge to use it, you don’t have to be a bookkeeper or accountant to navigate it. If you have used other accounting systems you will grasp it quickly.

Don’t let the fear of a difficult set up put you off making a necessary change

You may be realising it’s time for a change in software – either from a traditional desktop programme that no longer serves you, or to a different cloud software with more suitable features.

But often the fear of any kind of big change puts us off. There’ll be systems to adjust and people to train. Surely it’ll be months of learning curves and teething problems? Well, it doesn’t have to be.

At Myers Clark we have a team of cloud accounting specialists to help make the transition or set up seamless. We want you to be excited about the possibilities a new software can bring, not creating an even bigger drain on your time.

Check out our dedicated cloud accounting page to see what’s involved in a move, and for answers to the most frequently asked questions our clients have.